Net Present Value with uncertainty

Net Present Value with uncertainty

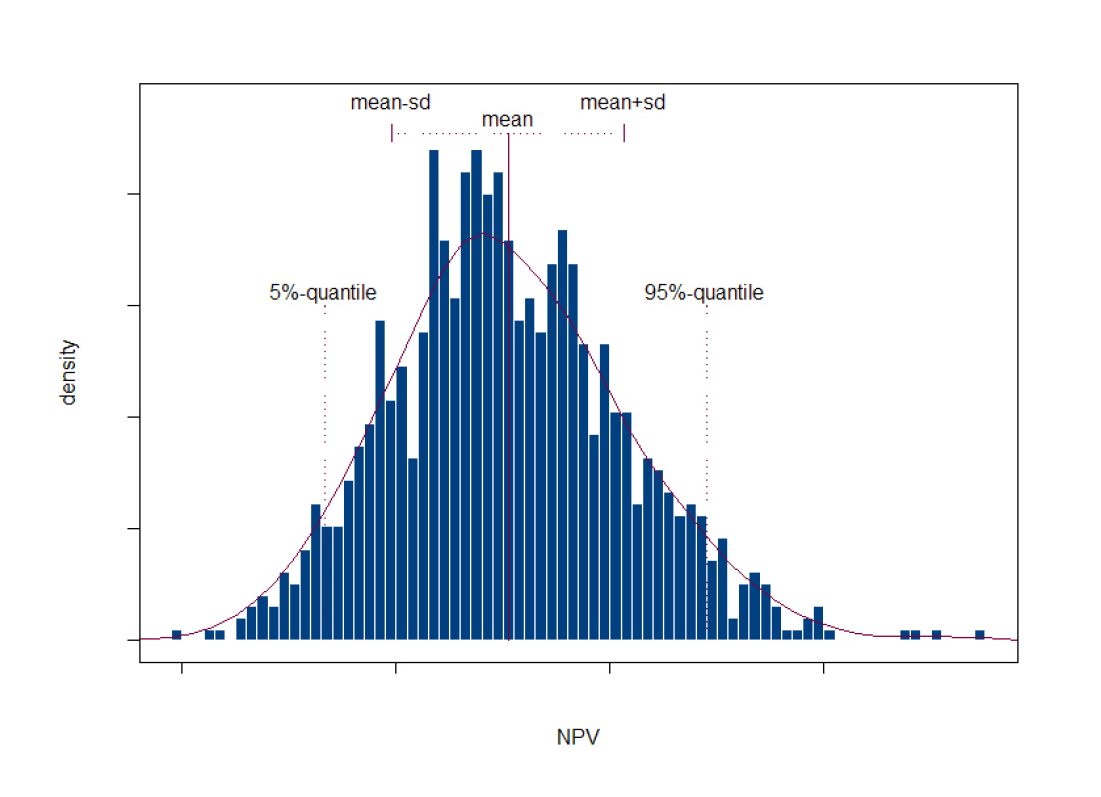

Prior to commencement, projects may be evaluated and compared according to their Net Present Value (NPV). The NPV is the discounted expected revenues minus the costs over the lifetime of the project. Traditional NPV calculations do not take into account the uncertainty in the different prices that influence the revenue- and cost elements. There are several different methods to account for risk and uncertainty in such calculations, for instance to increase the discount rate, compare pessimistic and optimistic cash flows, or sensitivity analyses.

In this project for Boliden, Odda, we have used a simulation approach to incorporate uncertainty evaluations in the NPV calculations. We have built a stochastic model for the most influential input variables of the NPV calculation of Boliden. The model includes components such as the zink metal price, energy price and exchange rates. From this model we simulate correlated scenarios of these variables and for each scenario the NPV is calculated. This way, the probability distributions for the important input variables are incorporated in the NPV calculations. As a result one obtains the probability distribution of the NPV. This allows us to find measures of the uncertainty of the NPV, such as the confidence interval and the Value-at-Risk (VaR).

Financing

Boliden, Odda

How to get to NR

How to get to NR Share on social media

Share on social media Privacy policy

Privacy policy